- Have any questions?

- Office: +1 (650) 345-8510

- Mobile: +1 (650) 576-6916

- norm@traveltechnology.com

How Can Regional TMCs Adapt to New Financial Models?

How OS Travel Buttons (iTravel, Google Travel) Will Change the Mobile Travel Landscape

March 8, 2012The Impact of Mobile OS on Travel Distribution

April 30, 2012The corporate travel market has always been a bit of a paradox. Non-travel industry observers might assume that the big four Travel Management Firms (TMCs) – American Express, Carlson Wagonlit, BCD Travel and HRG – own 80% of the corporate market (the Pareto principle). Though these four TMCs do dominate the Fortune 500, overall they represent less than 50% of the corporate market volume. This is particularly true when you include the full spectrum of companies from unmanaged to lightly managed to heavily managed programs. There are over 100 regional TMCs through the US and 1,000s throughout the world. Despite the Big Recession, many regional TMCs continue to report strong profits and growth, but is this sustainable?

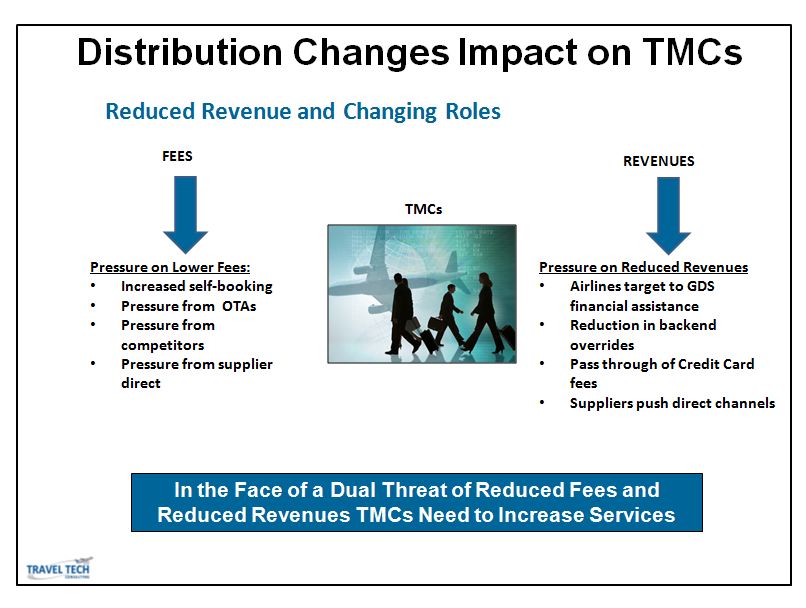

Most regional TMCs are under economic pressure on the fees they charge for their services and the revenues they receive from suppliers and the GDS. A challenging paradox for all TMCs is the issue of online adoption. As TMCs push greater online adoption through corporate booking tools, the service fees paid by their corporate accounts shrink. For the past decade, the second and third tier TMC market has been complicated by the growth of the Internet-based TMCs, the corporate versions of the OTAs, who have successfully captured major share in the market by promoting low online fees. Competition is still fierce from not only these iTMCs, but the mega-TMCs and the regional TMC’s direct competitors. There is also the continued effort by the suppliers to drive more business direct.

A major source of revenue for TMCs are the backend payments they receive from the GDS and suppliers. The latest airline/GDS battle is driven both by a desire for the airlines to lower their distribution costs and a goal to create a more personalized airline experience by getting closer to the customer and allowing the traveler to bundle ancillary services that meet their needs. On the cost side, the financial assistance which is derived from airline segment fees that are passed through to TMCs is a major target of the airlines’ renegotiation efforts. Airlines are also becoming tougher on the criteria for backend override (commission) payments. Airlines in Europe have begun passing along the cost of credit card fees to the TMC. The major global airline brands are embracing the OpenAxis Group standards with most working with Farelogix on alternative distribution (GDS bypass) strategies. At the end of the day, does this mean the glory days of the regional TMCs are over?

That depends on how these companies adapt to this changing market. Clearly the old ways of doing business will not be sustainable with all these threats to a TMC’s profitability. Here are some suggestions on what regional TMCs can to today:

- Embrace mobile technology: The business traveler is the early adopter of mobile technology and driving the use of mobile as an essential tool for business travel. Most of the corporate travel industry has been slow to recognize the mobile opportunity. The first step for any TMC is to provide a mobile based itinerary. This can be done by partnering with tools such as TripIt, Tripcase or Worldmate. Integrating these mobile itineraries into the TMC’s overall operation and technology is the key to bring value to these tools. Booking on mobile is still emerging, but a clear trend has already emerged where hotels, cars and ancillary services (restaurants, transfers event tickets, parking) are the first travel items to be sold on mobile. For air tickets, the key is to provide services related to disruption, helping the traveler when something goes wrong (e.g. cancellations, change in trip plans). Partnering with corporate booking tool providers on mobile efforts is a logical path for regional TMCs. The most important opportunity for a TMC’s mobile strategy is the process of continuous engagement. TMCs must execute mobile services that are available throughout the entire trip cycle, providing the right service (personalization) to the right traveler (location) based on the right situation (context).

- Use BI to offer consulting services : The mega-TMCs have successfully operated consulting practices for over 15 years. Regional TMCs generally offer all services through their account management organizations at no additional fees. By deploying more comprehensive business intelligent platforms (BI) regional TMCs can develop consulting services for a fee. These services include evaluating the impact of negotiated programs and creating and measuring Key Performance Indicators (KPIs) that track traveler compliance and measure travel management effectiveness.

The business world has numerous examples of companies that have not altered their strategy when the market changes, often with dismal results. Regional TMCs throughout the globe cannot not be complacent with current fees and revenue sources and must today embark upon new strategies to sustain profitability over the next decade.