- Have any questions?

- Office: +1 (650) 345-8510

- Mobile: +1 (650) 576-6916

- norm@traveltechnology.com

Ancillary Fees and Merchandizing

Airline Twitter Network Analysis with NodeXL

March 22, 2010Google and ITA Software

April 27, 2010 The media is filled with stories on airline ancillary fees especially with Spirit Airlines announcing a fee for carry-on baggage and Ryanair contemplating pay toilets. These charges represent a much bigger change in travel distribution than simply paying for services that were previously free. From multiple industry sources it is clear to me that we are only at the very beginning of this merchandizing trend which likely expand to other services and other sectors such as hotels. The trend will move to equating added services with value such as small fee for more leg room or a room away from the elevator. The impact on distribution is significant.

The media is filled with stories on airline ancillary fees especially with Spirit Airlines announcing a fee for carry-on baggage and Ryanair contemplating pay toilets. These charges represent a much bigger change in travel distribution than simply paying for services that were previously free. From multiple industry sources it is clear to me that we are only at the very beginning of this merchandizing trend which likely expand to other services and other sectors such as hotels. The trend will move to equating added services with value such as small fee for more leg room or a room away from the elevator. The impact on distribution is significant.

In other industries consumers have become accustomed to buying products or services from a menu of choices. Personalization of purchases is inherent in Web e-commerce. The travel industry and especially the airline industry has been fighting commoditization for years, but with little success. With each installation of a new video entertainment system a similar product is launched by a competitor. No matter who you fly the planes were either manufactured by Boeing or Airbus, thus true product differentiation is difficult.

The current trend toward ancillary fees originated with the Low Cost Carriers. With the fuel crisis in 2008, these fees were embraced by all airlines, first for checked baggage and then to meals and other services. A parallel effort pioneered by Air Canada and Frontier Airlines brought to the market branded or family fares with services bundled based on the price paid. This was the first evidence of true airline merchandizing. It is now clear that the concept of merchandizing is at the heart of the ancillary fee/unbundling trend. Corey Garner, director of merchandizing at AA recently stated : “In the end, I believe customers will recognize that airlines had to first break apart their services before they could be reassembled in interesting, cost-effective ways to benefit both airlines and customers.”

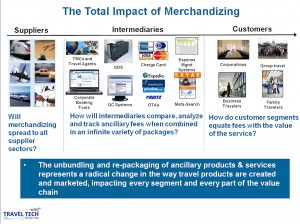

But as my slide illustrates, there are a number of question unanswered by this trend:

1) Will merchandizing spread to all supplier sectors?

It can be said that hotels already charge for ancillary services such as parking, Internet Access and other amenities. Further unbundling and simplification of hotel rates is likely with base rates stripped of many amenities and bundling directed at specific segments and channels.

2) How will intermediaries compare, analyze and track ancillary fees when combined in an infinite variety of packages?

The GDS all will be introducing ancillary revenue solutions later this year, but these only help bring the fees into the selling process. All points of consumer contact including the OTAs, Meta-Search engines, and corporate booking tools need to revise their point of sale interface to accommodate these fees, but will continue to struggle with airline merchandizing efforts whee fees are bundled together for specific market segments. Solution from ARC in the form of the Electronic Miscellaneous Document (EMD) or new fare categories from ATPCO are two industry efforts to better account for the fees, but each have been slow to market while merchandizing efforts have intensified. Expense management and corporate charge card providers need to only track these fees but help corporations determine which fees are allowable under travel policy.

3) How do customer segments equate fees with the value of the service?

Clearly consumers do not like the “nickel-and-diming” aspect of these fees, but how do they feel about the bundling of services or the purchase of added value items (e.g. added leg room) is still not clear. For frequent fliers who often have many of these fees waived, this may simply increase loyalty to one’s preferred airlines. Corporations continue to struggle with understanding the total cost of travel and keeping policy current with what is allowable verses non-reimbursable. For example, I believe you would find few companies who have policy on whether the $8 charge for a pillow and blanket on AA is reimbursable, at least at the moment. How these fees impact other segments such as groups, family travel, etc.. is still an unknown.

This is obviously a very fluid issue, but one that will likely increase in intensity as travel products continue to be unbundled and then repackaged or sold as added value services by the airlines and other industry segments.