- Have any questions?

- Office: +1 (650) 345-8510

- Mobile: +1 (650) 576-6916

- norm@traveltechnology.com

Google / ITA and the GDS

GUI Finally Comes to the Agent POS

July 9, 2010Video on Social Media, Social Networking and the Social Web

August 6, 2010Now that the Google acquisition has been announced a great deal speculation has emerged as far as Google’s intentions. Given the fact that regulatory approval is required and that the deal has not been completed, ITA itself has been unable to speculate on Google’s strategy. Google has devoted some energy in stating that it will not become a seller of travel, but hasn’t disclosed specifics on their plans other than stating that it will improve the consumer shopping experience.

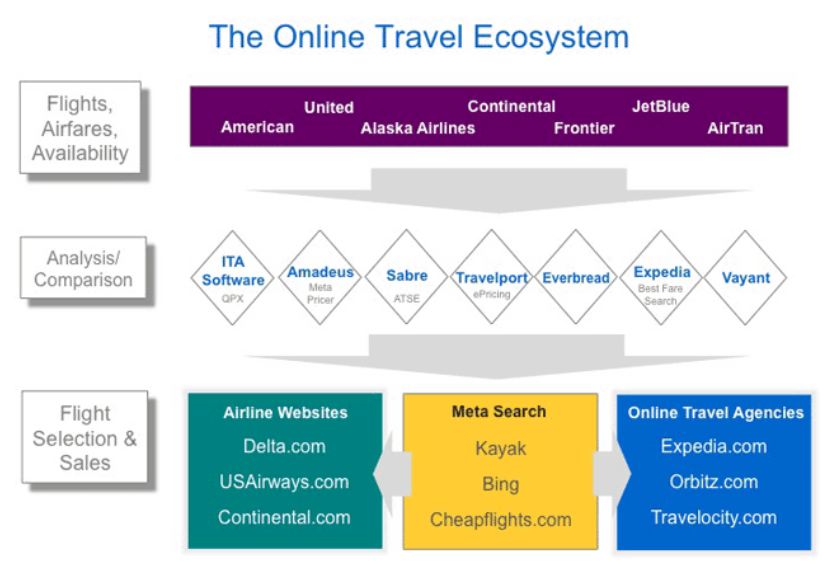

This chart which Google introduced regarding the acquisition has some interesting implications. Certainly a main goal of this diagram is to show the world (and the DOJ) that there is competition out there for Analysis/Comparison as part of the ecosystem. I believe there is more to this diagram than simple positioning.

1) Flights, airfares, availability- Airfare distribution is built on three legs – (1) schedules – published through OAG (2) Fares published through ATPCO and (3) availability housed in the airline passenger reservation systems. Most of the airlines either have their passenger reservation system hosted on a partition of a GDS or use a third party application (which also may be provided by a GDS) to run their reservation process. An area that is being overlooked by much of the press coverage regarding ITA is that fact that they have built a next generation airline passenger reservation system. Pundits are quick to point out that the initial launch customer, Air Canada, postponed the implementation of the new passenger reservation system and point to this fact that the system was a failure. I have no doubt that the system has had problems, but to say it is not functional is too broad of an assumption. Airlines have needed a new passenger reservation platform for decades. The GDS, Navitaire and 3rd party providers such as Radixx all provide platforms. Tech companies such as HP are building a new passenger reservation system for American Airlines. In many cases these systems are actually housed and run by third party companies. The Cloud provides a new spin on passenger reservation systems and Google’s acquisition of ITA may lead to a new player in this sector offering passenger reservations capabilities in the Cloud. This fits well with Google’s Cloud computing emphasis and may signal a significant change in airline distribution. The current airline/GDS battle is no longer about price as it was back in the last renewal cycle in 2005. The current controversy is over control over fares, ancillary services and customer ownership. AA is actually stating that they want to deliver every fare and related services on a customer by customer basis through an XML feed deciding on what to charge and what services to include based on customer value. In Google’s ecosystem chart the airlines are on top and ultimately dictate distribution terms. A Cloud based passenger reservation system using the ITA software platform could provide more control and flexibility for the airline and actually disrupt the current distribution environment. This means new competition for all vendors in the passenger reservation space and could signal a continued move to more channel based pricing negating the single price published through the single channel model that has been the backbone of the industry for decades.

2) Analysis / Comparison – Back in the early 2000s, ITA helped accelerate the urgency for the GDS to update their fare quoting software. Whether it was the Worldspan/Expedia Best Fare Search engine or re-written applications from Sabre or Amadeus, ITA forced the GDS to move this function off the mainframe and re-write it so it produced a greater number of choices. The chart shows that the GDS do have an opportunity to replace ITA as the fare quoting engine for airlines or meta-search players, but this is provided that they still have access to total information. The current push by the Axis group to dictate to that the industry use the Farelogix XML schema has not yet been embraced by the GDS. The GDS are certainly capable of handling XML feeds, but the shifting from a total published environment to one where the airlines passenger reservation system control price and ancillary services could greatly weaken the control the GDS have on distribution. No wonder the audience during our recent PhoCusWright panel discussion wondered why we left the GDS off the list of potential players at risk due to the Google ITA acquisition. This issue may actually play well with the DOJ as the GDS currently have an strong oligopoly on travel distribution and new competition would help improve products for the whole industry.

3) Flight Selection and Sales – The interesting part of this chart is that Google did not list ITA as a direct competitor to the Meta Search players though most of the press and pundits believe this is where they will compete.

One way to look at this chart is that inventory could be delivered through a variety of paths. Airline to 3rd party such as Google/ITA or Vayant and then directly to the airline, for example. With all the current airline/GDS tension, the idea of true GDS bypass may emerge if the acquisition is approved. Don’t get me wrong, I often believe the industry’s rhetoric that the GDS are dinosaurs and will fade into history, is similar to the famous Mark Twain quote” “The reports of my death have been greatly exaggerated.”. I believe the GDS are strong players within the travel distribution landscape and will remain so for many years to come. A Google ITA Cloud alternative combined with the airlines push for more control may mean that new competition is on the horizon for the GDS.